Dicgc Act

- For example: If a person has a deposit with a principal amount of Rs. 95,000/- and the interest on that amount is Rs. 4,000/-, then the total amount insured by DICGC is Rs. 99,000/-, however, if the principal amount is Rs. 1,00,000/- the further interest accrued will not be insured as the threshold on insurance cover is Rs. 1,00,000/- only.

- Read latest news and live updates on Dicgc-act including breaking news on Dicgc-act,Dicgc-act photos,Dicgc-act videos and many more at cnbctv18.com.

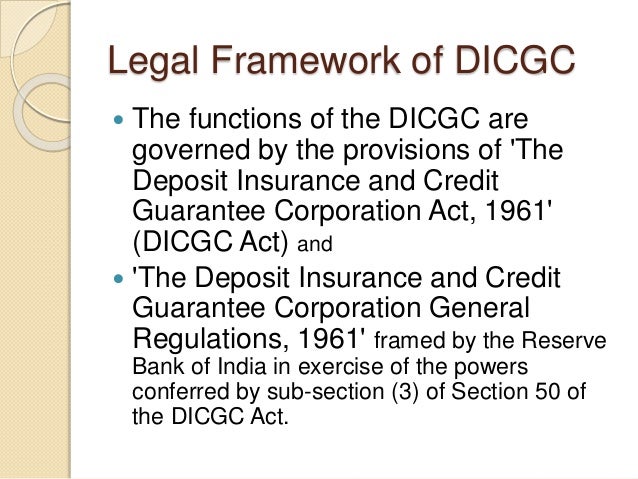

The functions of the DICGC are governed by the provisions of The Deposit Insurance and Credit Guarantee Corporation Act, 1961 (DICGC Act) and The Deposit Insurance and Credit Guarantee Corporation General Regulations, 1961 framed by the RBI in exercise of the powers conferred by Section 50(3) of the said Act. An Act to provide for the establishment of a corporation for the purpose of insurance of deposits. 1and guaranteeing of credit facilities and for other matters connected therewith or incidental thereto. SECTION 01: SHORT TITLE, EXTENT AND COMMENCEMENT (1) This Act may be called 2The Deposit Insurance and Credit Guarantee Corporation Act, 1961.

Know how much your Bank Deposit is Safe and Covered by Insurance of DICGC

What is the role of DICGC?

DICGC stands for Deposit Insurance and Credit Guarantee Corporation. The functions of the DICGC are governed by the provisions of The Deposit Insurance and Credit Guarantee Corporation Act, 1961 (DICGC Act) and The Deposit Insurance and Credit Guarantee Corporation General Regulations, 1961 framed by the RBI in exercise of the powers conferred by Section 50(3) of the said Act.

The preamble of the Deposit Insurance and Credit Guarantee Corporation Act, 1961 states that it is an Act to provide for the establishment of a Corporation for the purpose of insurance of deposits and guaranteeing of credit facilities and for other matters connected therewith or incidental thereto. It is basically a safety net for bank deposits in India.

With a view to providing a greater measure of protection to depositors in banks the DICGC, raised the limit of insurance cover for depositors in insured banks from the present level of Rs 1 lakh to Rs 5 lakh per depositor with effect from 4th February, 2020 with the approval of Government of India. If a bank undergoes severe stress and is likely to fold, in such situations an account holders deposits up to Rs.5 lakh are insured by DICGC.

What does the DICGC insure?

The DICGC insures all deposits such as savings, fixed, current, recurring, etc. deposits except the following types of deposits:-

Deposits of foreign Governments;

Deposits of Central/State Governments;

Inter-bank deposits;

Deposits of the State Land Development Banks with the State co-operative bank;

Any amount due on account of and deposit received outside India

Any amount, which has been specifically exempted by the corporation with the previous approval of RBI.

What is the maximum deposit amount insured by the DICGC?

Each depositor in a bank is insured upto a maximum of 5,00,000 for both principal and interest amount held by him. The deposits kept in different branches of a bank are aggregated for the purpose of insurance cover and a maximum amount of upto Rupees five lakhs is paid.

Which banks are insured by the DICGC?

All commercial banks including branches of foreign banks functioning in India, local area banks and regional rural banks are insured by the DICGC.

The insurance cover is also extended to all the state, central and primary co-operative banks which have the amendments to allow RBI to intervene, wind up or supersede its management. This includes all co-operative banks.

At present all co-operative banks are covered by the DICGC.

Primary co-operative societies are not covered

Government and inter-bank deposits are not covered.

How is Ownership of Accounts determined?

Ownership here means bank accounts opened as individual, as a partner of a firm, as guardian for someone, as director of a company, jointly etc.

Dicgc Act 1961

A bank will first try to aggregate accounts with the same type of ownership across all its branches before deposit insurance is determined.

If the funds are deposited into separate banks they would then be separately insured.

How is insurance cover provided in case of joint accounts?

In the case of joint accounts, the bank will insure accounts based on the order of the names in the joint account. So a joint account in the order of X, Y and Z and another joint account of Y, Z and A will be considered separately for the insurance cover.

Will an account in the name of a proprietorship concern be considered separately from a sole proprietor while computing insurance cover?

An account opened in the name of proprietary concern where the individual is the sole proprietor, will be clubbed with the individual’s own account in his/her own capacity for insurance cover.

How is insurance cover computed?

Once the ownership is determined, all the current, savings, fixed deposits belonging to the owner are aggregated to determine the insurance cover for the account.

Although the bank guarantees the amount, it does take a while for that money to be paid to its liable depositors.

When is DICGC liable to pay?

When a bank goes into liquidation

DICGC is liable to pay to the liquidator the claim amount of each depositor upto Rs 5 lakhs within 2 months from the date of receipt of claim list from the liquidator.

Dicgc Act Amendment

The liquidator has to disburse the claim amount to each insured depositor corresponding to their claim amount.

When a bank is reconstructed or amalgamated / merged with another bank

The DICGC pays the bank concerned, the difference between the full amount of deposit or the limit of insurance cover in force at the time, whichever is less and the amount received by him under the reconstruction / amalgamation scheme within 2 months from the date of receipt of claim list from the transferee bank / Chief Executive Officer of the insured bank/transferee bank as the case may be.

Dicc Ithaca Ny

New Delhi, Feb 1 (PTI) The government on Monday proposed changes in the DICGC Act to ensure depositors of troubled banks can withdraw their funds of up to Rs 5 lakh.

In the light of lenders like Punjab and Maharashtra Co-operative (PMC) Bank, Yes Bank and Lakshmi Vilas Bank running into trouble in recent times, the government had amended the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, raising the insurance cover on deposit five-fold to Rs 5 lakh.

'I shall be moving amendments to the DICGC Act, 1961 in this Session itself to streamline the provisions, so that if a bank is temporarily unable to fulfil its obligations, the depositors of such a bank can get easy and time-bound access to their deposits to the extent of the deposit insurance cover,' Finance Minister Nirmala Sitharaman said in her Budget speech.

This would help depositors of banks that are currently under stress, she added.

DICGC, a wholly-owned subsidiary of the Reserve Bank of India, provides insurance cover on bank deposits.

As per the current provisions, the deposit insurance of up to Rs 5 lakh comes into play when the licence of a bank is cancelled and liquidation process starts.

Meanwhile, the Reserve Bank of India (RBI) on Monday said it has cancelled the licence of Shivam Sahakari Bank, Ichalkaranji, Kolhapur, Maharashtra.

The Commissioner for Cooperation and Registrar of Cooperative Societies, Maharashtra has also been requested to issue an order for winding up the bank and appoint a liquidator for the lender, it said.

'With the cancellation of licence and commencement of liquidation proceedings, the process of paying the depositors of Shivam Sahakari Bank Ltd, Ichalkaranji, Kolhapur, Maharashtra as per the DICGC Act, 1961 will be set in motion,' RBI said.

The central bank also said that as per the data submitted by the bank, more than 99 per cent of the depositors are fully insured by DICGC.

On liquidation, every depositor would be entitled to receive deposit insurance claim amount of his/her deposits up to a monetary ceiling of Rs 5 lakh from the DICGC, subject to provisions, it added. PTI DP NKD DP ABM

ABM