Paytm Fixed Deposit

- Paytm Fixed Deposit Credit Cards

- Paytm Fixed Deposit Calculator

- Paytm Fixed Deposit Customer Care Number

Jun 21, 2019 Paytm Payments Bank provides Fixed Deposit facility to its customers in partnership with its partner Bank. The article below contains all the information you need to understand your returns, how TDS is deducted and how to get your Interest & Tax Certificates to file your Income Tax Returns (ITR). A mutual fund is a scheme in which several investors pool their money, which in turn gets invested by a professional fund manager. He/she may invest these contributions in stocks, bonds, gold, and/or a combination of these. PAYTM provides services like online shopping, online bill payments, online mobile recharge, TV recharge, and post-paid mobile bills etc including PAYTM Wallet in which you can keep the money for your daily/monthly expenses. RECURRING DEPOSITS. Recurring Deposit is a fixed amount. Discerning customers, as per their preference and convenience, can now choose to book an FD instantly either with IndusInd or Suryoday Bank via Fixed Deposits section available on the Paytm Payments Bank home screen. Multi partner FD – Features One of its Kind: Paytm Payments Bank has seen millennials preferring FD over other investment options.

Firstly, we know that what is Paytm Payment Bank, after that we will know how to add or deposit money in Paytm Payment Bank account?

What is Paytm Payment Bank?

Paytm Payment Bank is India’s first mobile bank where you can open your account with zero balance. In Aug 2015, Paytm Payment Bank was licensed by the Reserve Bank of India. Its founder is Vijay Shekhar Sharma and Satish Kumar Gupta as a CEO & Managing Director. The bank was inaugurated by Indian Finance Minister Arun Jaitley in November 2017.

You can deposit your money up to 1 lakh in this bank and earn interest at 2.75% per annum which will be paid every month. You will also get a free Virtual Rupay Debit Card by the bank, which can help you in doing online transactions. If you want, you can also get a physical debit card by paying Rs.250 Physical Card Issuance Charge. After this, you will have to pay an annual subscription fee of Rs.150 and the daily limit will be up to Rs.1,00,000.

How to add or deposit money in Paytm Payment Bank account?

Follow these 5 steps to add or deposit money in Paytm Payment Bank Savings Account:

1. UPI Linked Bank Account

You can add money in Paytm Payment Bank from your UPI linked bank account. If you don’t see any UPI Linked Bank account there that means you haven’t any UPI Linked handle yet and you have to first link your UPI handle then after you will be able to add money.

- Enter the amount you want to add

- Select your UPI Linked Bank Account and click the Proceed Securely button

- Enter your 6 digit UPI pin and click OK

- Now, your money will be successfully added to the Paytm Payment Bank account.

2. Paytm Wallet

You can add money up to Rs.100 to 25,000 from Paytm wallet in Paytm Payment Bank and you will be able to add money as much as the balance in your wallet.

- Enter the amount you want to add

- Select the Paytm balance option and click on the Proceed button

- Enter the OTP sent in your Paytm registered mobile number and click on verify

- Now, your money will be successfully added.

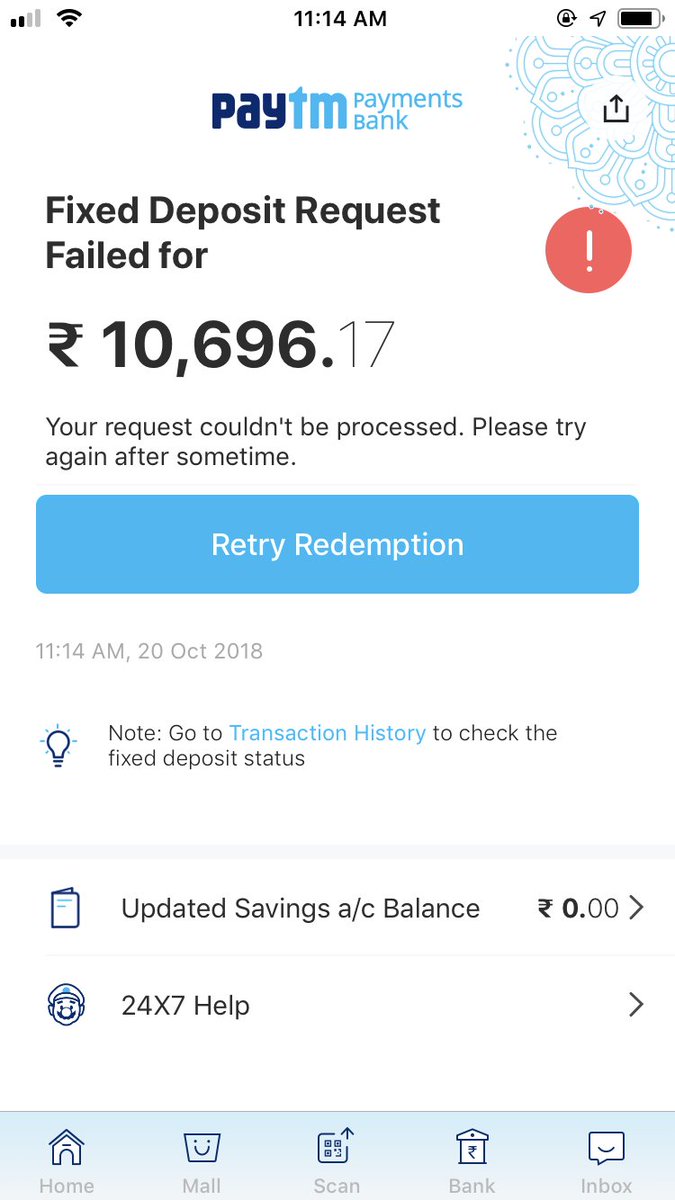

3. Fixed Deposit

You can add money by the Fixed Deposit process only if you have made a Fixed Deposit at the Paytm Payment Bank. To add money, you have to break your Fixed Deposit.

- Enter the amount you want to add

- Select Break Your Fixed Deposit option

- Lastly, click on the Proceed button to add the money.

4. Debit Card

To add money in Paytm Payment Bank with a debit card by entering the details of your Debit Card. You can add only 2000 rupees at a time.

- Enter the amount you want to add

- Select the Debit Card option

- Fill in your Debit Card details ( Card Number, Expiry Date and CVV )

- If you don’t want to fill in these details again, then you should tick on ‘Save this card for future payments’. After this, you have to enter the CVV number and OTP only to add the money.

- Click on Proceed Securely and enter the OTP sent in your registered mobile number to complete the transaction.

5. Your Account With Another Bank

You can add money from another bank account by opening your another bank’s app and website. Fill in your Name, Account Number, IFSC code of Paytm Payment Bank to transfer money.

6. Nearby Points

You can also add money by visiting nearby points of Paytm. Firstly, You have to locate your Nearby Points by clicking on ‘Visit Nearby Points to deposit cash in Savings Account’. When you give cash to Paytm official point, your money is added in Paytm Payment Bank.

Read more: Full details of Meesho Supplier Panel or Login

How Much Loan Can I Get?

What Is the Rate of Interest?

What Is the Loan Tenor? How Is the Loan Repaid?

The loan tenor can’t exceed tenor of the deposit.

You can close the loan whenever you wish.

What Are the Benefits?

Points to Note

Does Loan Against Fixed Deposit Make Sense?

- You can break the FD prematurely and use the funds to meet your requirement.

In general, do not opt for loan against your bank fixed deposit. Rather, break your fixed deposit and use the funds to meet your requirement.

When Can Loan Against FD Make Sense?

I can foresee utility of loan against FD if the loan amount is much lesser than the FD amount and the interest rates have gone down significantly after you opened the fixed deposit. Penalty for breaking FD is also important variable.

- If you do not break the fixed deposit